Is the Future Multi-Chain? Exploring Cross-Chain Innovation

The blockchain ecosystem has witnessed rapid evolution over the past decade, transitioning from Bitcoin’s singular focus on decentralized digital currency to a vibrant landscape populated with a multitude of platforms, each serving distinct purposes.

As the number of blockchains expands, a fundamental question arises: is the future of blockchain inherently multi-chain? And if so, how will cross-chain innovations shape the digital economy, decentralized finance (DeFi), and Web3 applications? This article delves into the drivers, challenges, and potential of a multi-chain future.

The Rise of Multi-Chain Ecosystems

Historically, blockchain projects operated in relative isolation. Bitcoin introduced the concept of a decentralized ledger for currency, while Ethereum extended this to smart contracts, enabling decentralized applications (dApps). However, as more blockchains emerged—such as Binance Smart Chain, Solana, Polkadot, Cardano, and Avalanche—developers faced a fragmented ecosystem. Each blockchain offered unique advantages: Ethereum’s robust smart contract environment, Solana’s high throughput, and Polkadot’s cross-chain interoperability.

This proliferation gave rise to a multi-chain ecosystem where users and developers must navigate multiple platforms, each with its own tokens, governance mechanisms, and technical requirements. While this diversity fosters innovation, it also creates silos that inhibit seamless interaction across chains.

Understanding Cross-Chain Innovation

Cross-chain innovation refers to technologies and protocols that enable communication, asset transfer, and data sharing between separate blockchains. Unlike single-chain systems, where all activities occur on one network, cross-chain solutions bridge different platforms, facilitating interoperability and expanding functionality.

Key methods of cross-chain innovation include:

-

Bridges: Protocols that allow tokens or data to move from one blockchain to another. For example, Wrapped Bitcoin (WBTC) enables Bitcoin to function on the Ethereum network.

-

Sidechains: Independent blockchains connected to a main chain to handle transactions more efficiently while maintaining compatibility with the main network.

-

Interoperability Protocols: Frameworks like Polkadot’s relay chains or Cosmos’ Inter-Blockchain Communication (IBC) protocol aim to standardize cross-chain communication.

-

Atomic Swaps: Decentralized mechanisms for exchanging assets across different blockchains without the need for a centralized intermediary.

These innovations not only enhance liquidity and usability but also reduce the risk of centralization by enabling decentralized ecosystems to work together rather than in isolation.

Benefits of a Multi-Chain Future

Adopting a multi-chain model could offer significant advantages:

1. Increased Flexibility and Choice

Users can select blockchains based on transaction speed, cost, and specific use cases. For example, high-frequency trading dApps might prefer Solana for low-latency transactions, while NFT marketplaces may leverage Ethereum’s established infrastructure and security.

2. Enhanced Resilience

Multi-chain systems reduce reliance on a single blockchain. In the event of congestion, downtime, or security breaches, other chains can maintain the network’s functionality, improving overall resilience.

3. Expanded Innovation

Developers can leverage unique features from multiple chains simultaneously. Cross-chain protocols allow combining strengths of various networks, fostering creativity and efficiency in application development.

4. Broader Market Access

Cross-chain interoperability enables users to access liquidity, decentralized finance products, and NFTs across platforms without being confined to a single chain. This could catalyze wider adoption and integration into mainstream financial systems.

Challenges Facing Multi-Chain Adoption

Despite its potential, a multi-chain future is not without obstacles:

1. Security Risks

Cross-chain bridges have become targets for cyberattacks. The complexity of moving assets between networks introduces vulnerabilities that can lead to significant financial losses.

2. Technical Complexity

Developing and maintaining cross-chain protocols requires advanced expertise. Ensuring compatibility and synchronization across chains is technically challenging and resource-intensive.

3. Fragmented Governance

Different blockchains have diverse governance models, which complicates decision-making, protocol upgrades, and community consensus in multi-chain ecosystems.

4. User Experience

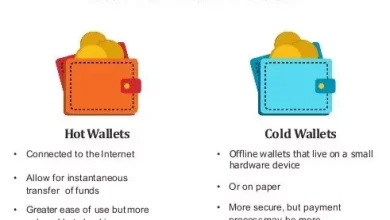

For mainstream adoption, users need seamless interfaces. Currently, managing assets across multiple chains can be confusing, requiring wallet integrations, bridge transactions, and manual verifications.

Real-World Examples of Cross-Chain Applications

Several projects are actively exploring cross-chain innovation:

-

Polkadot: Introduces parachains, specialized blockchains that connect to a central relay chain, enabling interoperability and shared security.

-

Cosmos: Utilizes the IBC protocol to allow independent blockchains to exchange value and data securely.

-

Thorchain: Facilitates decentralized cross-chain swaps without wrapped tokens, providing native asset liquidity across multiple networks.

-

LayerZero: Offers a messaging protocol designed for ultra-low-latency cross-chain communication.

These initiatives illustrate the practical benefits of multi-chain solutions, ranging from efficient asset transfers to enhanced DeFi operations and NFT interoperability.

The Role of Standards and Collaboration

For a true multi-chain future to emerge, standardization is critical. Just as the internet thrived on standardized protocols like TCP/IP and HTTP, blockchains need unified frameworks for interoperability. Collaborative efforts among developers, enterprises, and blockchain foundations will be essential to ensure secure, efficient, and user-friendly cross-chain solutions.

Moreover, regulatory clarity will play a pivotal role. Cross-chain transactions could raise compliance questions regarding anti-money laundering (AML), taxation, and digital asset ownership. Establishing clear guidelines will help bridge the gap between innovation and legal accountability.

Looking Ahead: Is Multi-Chain the Inevitable Future?

The blockchain landscape is evolving from isolated networks toward a connected ecosystem, driven by the need for scalability, liquidity, and innovation. Multi-chain systems, supported by cross-chain protocols, offer flexibility, security, and creative potential that single-chain architectures struggle to provide.

However, the journey is ongoing. Achieving seamless cross-chain interoperability requires overcoming significant technical, security, and governance challenges. Developers must prioritize robust bridge solutions, standardized protocols, and intuitive user experiences to unlock the full potential of a multi-chain world.