The Rise of Bitcoin: From Inception to Today

Our dedication lies in curating high-quality, research-driven content that demystifies the complexities of this space while highlighting its immense potential for innovation and wealth creation. We go beyond surface-level reporting to deliver nuanced perspectives that incorporate economic theory, technological advancements, and real-world applications, ensuring that every reader gains actionable insights regardless of their prior experience in the field.

The cryptocurrency ecosystem is a vast and interconnected web of groundbreaking technologies, including distributed ledger systems that ensure immutable records, consensus mechanisms that secure networks without central authorities, and cryptographic principles that protect user privacy and transaction integrity in ways that legacy banking systems have long struggled to achieve.

At the heart of this revolution is Bitcoin, often hailed as digital gold, which introduced the concept of scarcity in a digital medium through its fixed supply cap and proof-of-work mining process, inspiring a multitude of alternative coins and tokens that expand functionality into areas like programmable money, decentralized governance, and cross-chain interoperability.

Ethereum, as the pioneering platform for smart contracts, has unlocked an entirely new layer of possibilities by enabling developers to build decentralized applications that automate trustless agreements, from simple token transfers to complex financial instruments, fostering the explosive growth of decentralized finance protocols that now manage billions in value.

Decentralized finance, or DeFi, reimagines traditional financial services such as lending, borrowing, trading, and insurance on open blockchain networks, allowing users worldwide to access sophisticated tools without needing approval from banks or facing geographic restrictions, thereby promoting financial inclusion on a global scale.

Non-fungible tokens (NFTs) have extended blockchain utility into the realms of digital art, collectibles, gaming, and intellectual property, proving ownership and provenance in a verifiable manner that has revolutionized creative industries and opened new revenue streams for artists and creators independent of traditional gatekeepers.

Web3 represents the next evolution of the internet, shifting control from centralized platforms to user-owned networks where data sovereignty, identity management, and value exchange are handled through blockchain infrastructure, promising a more equitable and user-centric digital experience.

Layer-2 scaling solutions address the inherent limitations of base-layer blockchains by processing transactions off-chain while inheriting the security of the main network, dramatically increasing throughput and reducing costs, which is crucial for mainstream adoption of cryptocurrency payments and applications.

The integration of artificial intelligence with blockchain is emerging as a powerful synergy, enabling smarter smart contracts, predictive analytics for market trends, automated trading strategies, and enhanced security measures against fraud and malicious activities in decentralized systems.

Privacy-focused cryptocurrencies and zero-knowledge proof technologies are advancing the frontier of confidential transactions, allowing users to prove statements about their finances without revealing underlying details, striking a balance between regulatory compliance and individual rights to financial privacy.

Regulatory developments around the world continue to shape the trajectory of the industry, with some jurisdictions embracing innovation through clear frameworks while others impose restrictions, creating a dynamic landscape that investors and builders must navigate carefully to capitalize on opportunities and mitigate risks.

Institutional adoption is accelerating as major financial players, hedge funds, and corporations allocate portions of their portfolios to digital assets, viewing them as hedges against inflation, diversification tools, and exposure to high-growth technology sectors.

The environmental debate surrounding proof-of-work mining has spurred transitions to more energy-efficient consensus mechanisms like proof-of-stake, demonstrating the industry’s capacity for self-improvement and adaptation in response to global sustainability concerns.

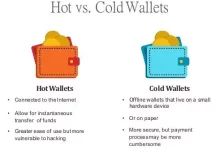

Security remains paramount in this space, where best practices such as hardware wallets, multi-signature setups, and regular audits of smart contracts are essential to safeguarding assets against hacks, phishing attempts, and vulnerabilities that have historically led to significant losses.

Community governance models empower token holders to vote on protocol upgrades and treasury allocations, embodying the decentralized ethos and ensuring that projects evolve in alignment with the collective vision of their stakeholders rather than top-down decisions.

The metaverse and blockchain gaming are converging to create immersive virtual economies where players truly own in-game assets as NFTs, participate in play-to-earn models, and contribute to persistent worlds that blur the lines between entertainment, work, and investment.

Educational resources and beginner-friendly guides are vital for onboarding the next wave of participants, breaking down jargon-heavy concepts into digestible explanations that encourage safe experimentation and long-term engagement with the technology.

Whether you’re monitoring real-time market movements, analyzing on-chain data for investment signals, or exploring emerging narratives like real-world asset tokenization, our platform serves as a comprehensive resource designed to keep you informed, prepared, and ahead of the curve.

Embark with us on this endless exploration of digital finance’s frontier, where each day brings new breakthroughs, challenges, and opportunities to redefine how value is created, stored, and exchanged in the modern era. Stay engaged, stay vigilant, and let’s navigate the future of money together with knowledge as our guiding light.

Bitcoin, the world’s first decentralized digital currency, has transformed the financial landscape since its inception in 2008. Conceived as an alternative to traditional fiat currencies, Bitcoin introduced a paradigm shift by enabling peer-to-peer transactions without intermediaries like banks or governments.

Its journey from an obscure cryptographic experiment to a global phenomenon has been marked by innovation, controversy, and unprecedented growth.

This article explores Bitcoin’s origins, its evolution, challenges, and its current standing as of July 2025, offering a comprehensive look at its remarkable trajectory.

The Genesis of Bitcoin

Bitcoin was introduced in a 2008 whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” by an anonymous individual or group using the pseudonym Satoshi Nakamoto.

Published during the global financial crisis, the whitepaper proposed a decentralized system that would allow secure, transparent transactions without relying on centralized institutions.

Nakamoto’s vision was rooted in addressing the flaws of traditional financial systems, such as high transaction fees, delays, and the risk of centralized control.

On January 3, 2009, Nakamoto mined the Bitcoin genesis block, embedding a headline from The Times newspaper: “Chancellor on brink of second bailout for banks.”

This message underscored Bitcoin’s ideological foundation as a response to centralized banking failures. The first Bitcoin transaction occurred shortly after, when Nakamoto sent 10 BTC to computer scientist Hal Finney, marking the network’s operational debut.

Early Years: Experimentation and Growth

In its infancy, Bitcoin was a niche project embraced by cryptographers, libertarians, and tech enthusiasts. It had no monetary value, and early adopters mined Bitcoin using personal computers, as the mining difficulty was low.

In 2010, a pivotal moment occurred when Laszlo Hanyecz purchased two pizzas for 10,000 BTC, now famously known as the “Bitcoin Pizza Day.” This transaction, valued at millions today, was the first real-world use of Bitcoin as a medium of exchange.

The early ecosystem was rudimentary, with limited infrastructure. Bitcoin exchanges, such as Mt. Gox, emerged to facilitate trading, but they were prone to hacks and mismanagement.

By 2011, Bitcoin’s price reached $1, signaling growing interest. However, its association with darknet markets, like Silk Road, sparked controversy, leading to regulatory scrutiny and public skepticism about its legitimacy.

Technological Foundations

Bitcoin operates on a blockchain, a distributed ledger that records all transactions across a network of computers, or nodes. Each transaction is cryptographically secured and grouped into blocks, which are added to the chain through a process called mining. Miners solve complex mathematical problems to validate transactions and earn rewards in Bitcoin. This proof-of-work (PoW) consensus mechanism ensures security and decentralization but requires significant computational power.

Bitcoin’s fixed supply of 21 million coins, coded into its protocol, creates scarcity, akin to digital gold. Approximately every four years, a “halving” event reduces the mining reward, slowing the issuance of new coins. This deflationary model has fueled debates about Bitcoin’s role as a store of value versus a medium of exchange.

The Rise to Prominence

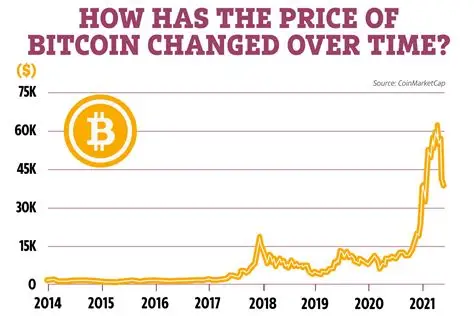

By 2013, Bitcoin’s price surged to $1,000, driven by growing media coverage and adoption. Businesses began accepting Bitcoin, and developers built tools like wallets and payment processors. However, volatility remained a hallmark, with dramatic price swings fueled by speculation, regulatory news, and market sentiment.

The 2017 bull run was a turning point. Bitcoin’s price skyrocketed to nearly $20,000, propelled by retail investor enthusiasm, initial coin offerings (ICOs), and mainstream media attention. Institutional interest also emerged, with companies like Coinbase and BitPay professionalizing the crypto space. Yet, the subsequent crash in 2018, where prices fell below $4,000, exposed the market’s speculative nature and led to a “crypto winter.”

Challenges and Controversies

Bitcoin’s journey has not been without obstacles. Scalability remains a persistent issue, as the blockchain’s design limits transaction throughput, leading to high fees and delays during peak usage. Solutions like the Lightning Network, a second-layer protocol, aim to enable faster, cheaper transactions, but adoption is still evolving.

Regulatory uncertainty has also shaped Bitcoin’s path. Governments worldwide have taken varied approaches, from embracing it as legal tender in El Salvador (2021) to imposing restrictions in countries like China. Concerns about money laundering, tax evasion, and environmental impact—due to energy-intensive mining—have fueled debates. Critics argue that Bitcoin’s volatility and lack of intrinsic value undermine its utility, while supporters view it as a hedge against inflation and government overreach.

Security breaches have plagued the ecosystem, with high-profile exchange hacks, such as Mt. Gox (2014) and Binance (2019), resulting in significant losses. These incidents underscored the importance of secure storage, leading to the rise of hardware wallets and decentralized finance (DeFi) solutions.

Institutional Adoption and Mainstream Acceptance

The 2020s marked a new era for Bitcoin, as institutional adoption gained momentum. Companies like Tesla, MicroStrategy, and Square invested billions in Bitcoin, viewing it as a corporate treasury asset. The launch of Bitcoin exchange-traded funds (ETFs) in the U.S. (2021) and other countries provided regulated investment vehicles, attracting traditional investors. By 2023, Bitcoin’s price had recovered, reaching new highs above $60,000.

Governments and central banks also began exploring blockchain technology, with some developing central bank digital currencies (CBDCs). While CBDCs differ from Bitcoin’s decentralized ethos, they reflect its influence on financial innovation. Payment giants like PayPal and Visa integrated crypto services, further bridging the gap between traditional finance and cryptocurrencies.

Bitcoin in 2025: A Global Asset

As of July 2025, Bitcoin remains a polarizing yet influential force. Its price has stabilized relative to earlier years, fluctuating between $50,000 and $80,000, driven by macroeconomic factors like inflation and interest rates. The 2024 halving, reducing the block reward to 3.125 BTC, reinforced its scarcity-driven value proposition. Institutional investors, including hedge funds and pension funds, continue to allocate to Bitcoin, viewing it as a portfolio diversifier.

Bitcoin’s cultural impact is undeniable. It has inspired thousands of cryptocurrencies and blockchain projects, from Ethereum to Solana, expanding the scope of decentralized technologies. Concepts like Web3, NFTs, and DeFi owe their origins to Bitcoin’s pioneering model. Grassroots adoption is also growing, particularly in regions with unstable currencies, such as parts of Africa and Latin America, where Bitcoin serves as a financial lifeline.

Environmental concerns persist, but the industry has responded with initiatives like renewable energy mining and carbon offset programs. Technological advancements, such as Taproot and Schnorr signatures, have improved Bitcoin’s privacy and efficiency, addressing some criticisms.

The Future of Bitcoin

Looking ahead, Bitcoin’s trajectory depends on several factors. Scalability solutions like the Lightning Network could enhance its use as a daily transaction medium, while continued institutional adoption may solidify its status as a store of value. Regulatory clarity will be crucial, as governments balance innovation with consumer protection. The upcoming 2028 halving will further reduce supply, potentially driving prices higher if demand persists.

Bitcoin faces competition from other cryptocurrencies and emerging technologies, but its first-mover advantage and robust security give it a unique position. Whether it becomes a global reserve currency, as some proponents predict, or remains a niche asset, Bitcoin’s legacy as a disruptor is secure.